10.4.How to Set up Global Configurations? ↑ Back to Top

To set up the configuration settings you need to provide the following details in the app.

Selling Details

The sellers are suggested to follow all the tax regulations that are expected by eBay on the sales.

To complete the selling details you need to set the following tax settings.

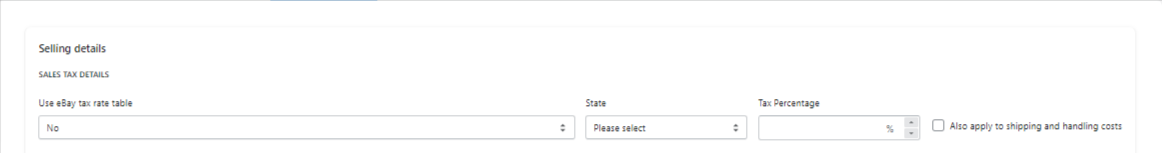

Sales Tax details are required for ebay.com & ebay.ca websites. For the rest of eBay websites, only VAT is applicable.

- Use eBay tax rate table: select Yes, if you use the tax table on eBay, else the option is No by default.

- State

- Tax Percentage

- Also, apply to shipping and handling costs

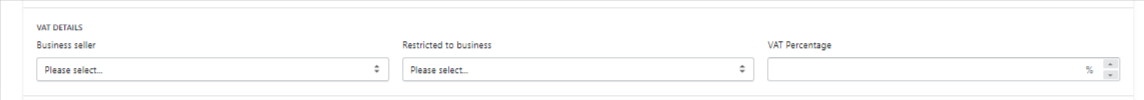

VAT details which require you to toggle between Yes and No for each option and a numerical value for the VAT percentage.

- Business Sellers

- Restricted to Business

- VAT percentage

General Settings

If you want images to be changed on ebay based on the variation then select the attribute for images rotation. Tick the checkbox that is required for the variation images. As eBay has a policy that lets the single variation rotate for the listings so you can select any one checkbox.

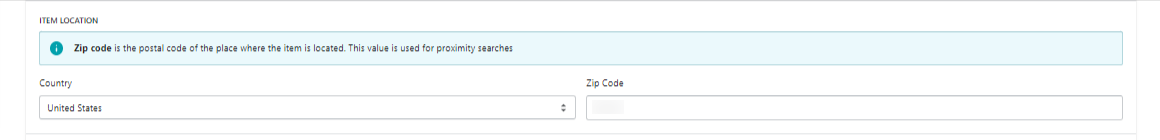

Item Location

You need to provide the selling details which include Item Location and Zip Code. This lets your Buyers know the ordered product location.

- Select the country and then enter the zip code for the location of your item.

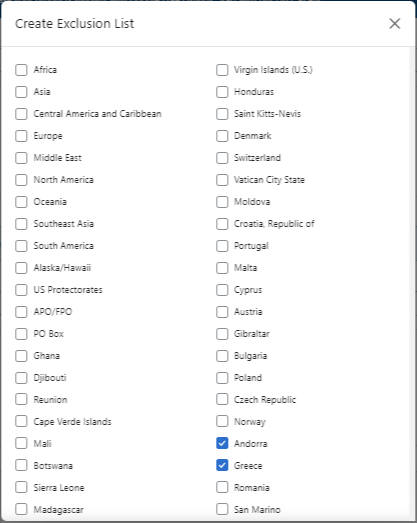

- In the case where you want to excuse the item location, you need to select the button that reads Create Exclusion List.1. Click on Create Exclusion List.

2. Select the countries you want to exclude and save the setting.