3.Presence of Validate Vat Button on Front-End View ↑ Back to Top

This section covers the information on the appearance of the Validate Vat button on the front-end view.

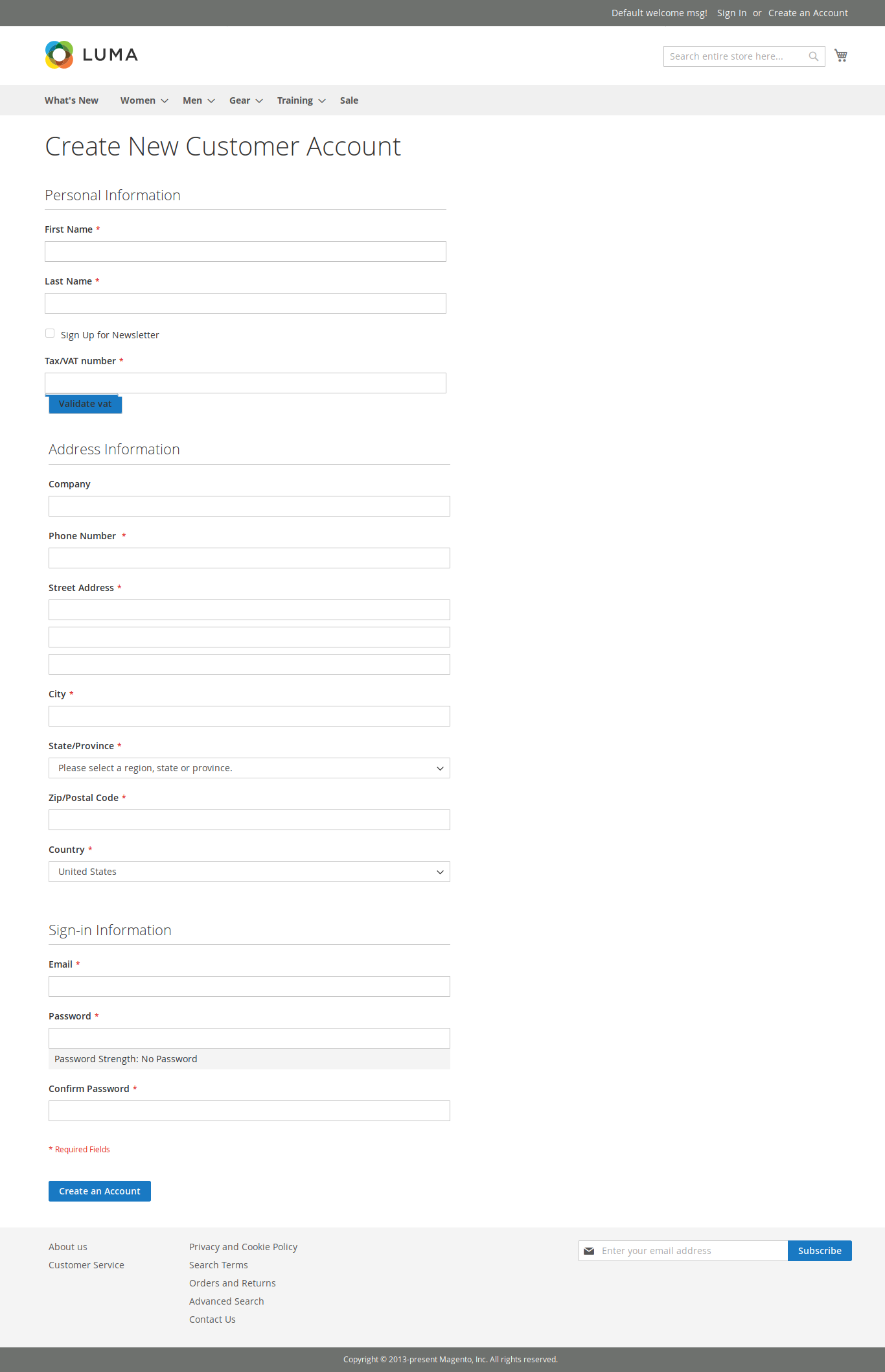

First Occurrence:

Create New Customer Account Page: The Validate Vat button appears on the page while creating a new customer account to check whether the Vat number is valid or not. It restricts the customers to submit the form if they enter an invalid vat number.

The button appears on the page as shown in the following figure:

- In the Tax/VAT number box, enter the VAT number, followed by selecting the country from the drop down and then click the Validate vat button to check if the number is valid.

Note: We need to select the country also, before Validate vat, since country code would also be applied with the vat code.

Only if the number is valid, the customer is allowed to submit the account creation form, else the error appears.

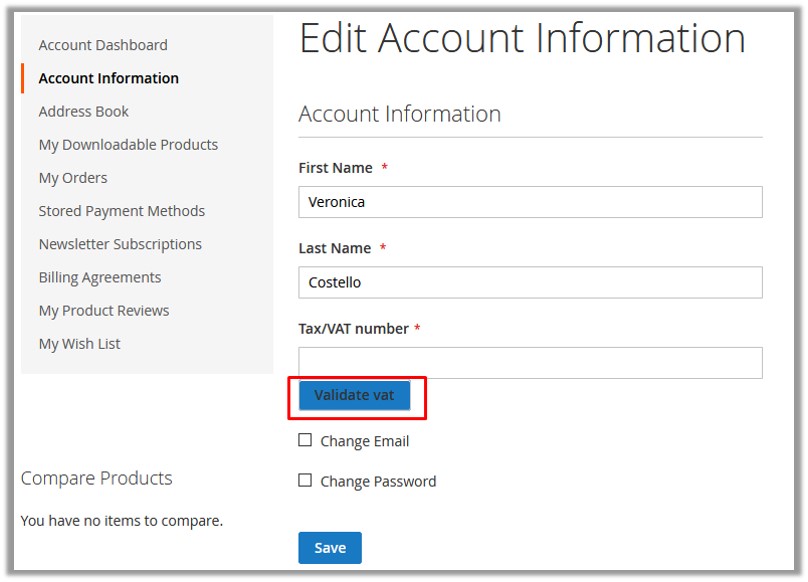

Second Occurence:

Edit Account Information Page: The Validate Vat button appears on the page while editing the customer account information to check whether the Vat number is valid or not. It restricts the customers to edit and save the information if they enter an invalid vat number.

- In the left navigation panel, click the Account Information menu.

The Edit Account Information page and the Validate Vat button associated with the Tax/VAT number field appears on the page as shown in the following figure:

- In the Tax/VAT number box, enter the VAT number and then click the Validate vat button to check if the number is valid.

Only if the number is valid, the customer is allowed to save the edited information, else the error appears.

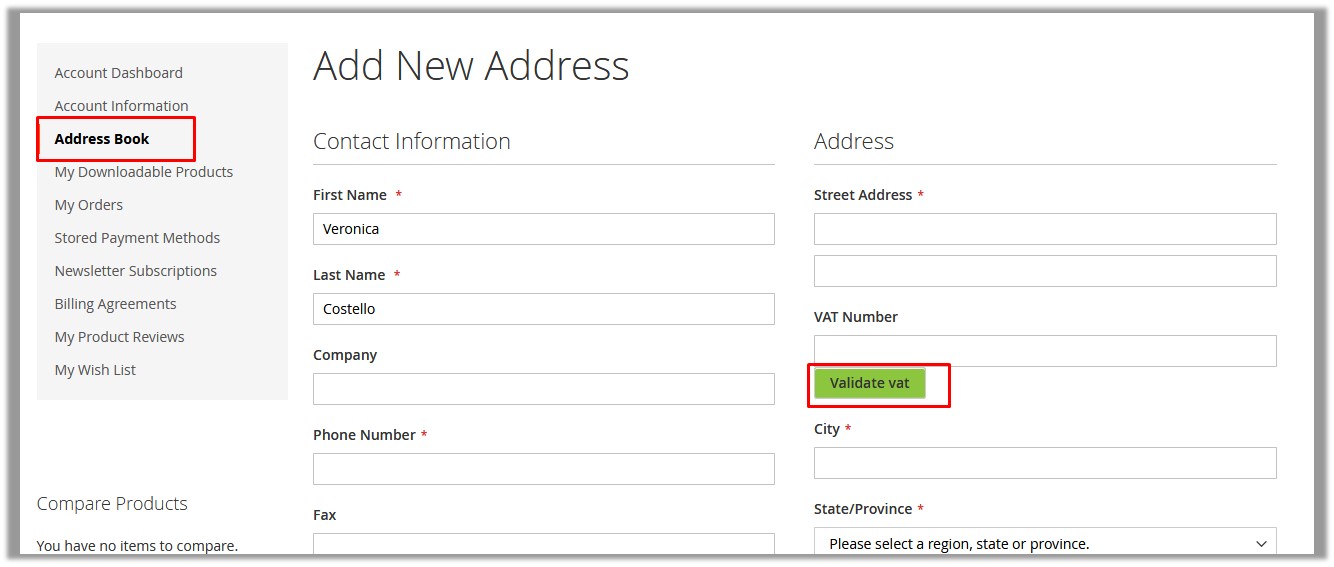

Third Occurence:

Add New Address page: The Validate Vat button appears on the page while adding new address through Address Book from My Account to check whether the Vat number is valid or not. It restricts the customers to add the new address if they enter an invalid vat number.

- In the left navigation panel, click the Address Book menu.

The button appears on the page as shown in the following figure:

- In the VAT number box, enter the VAT number, followed by selecting the country from the drop down and then click the Validate vat button to check if the number is valid.

Only if the number is valid, the customer is allowed to add the new address, else the error appears.

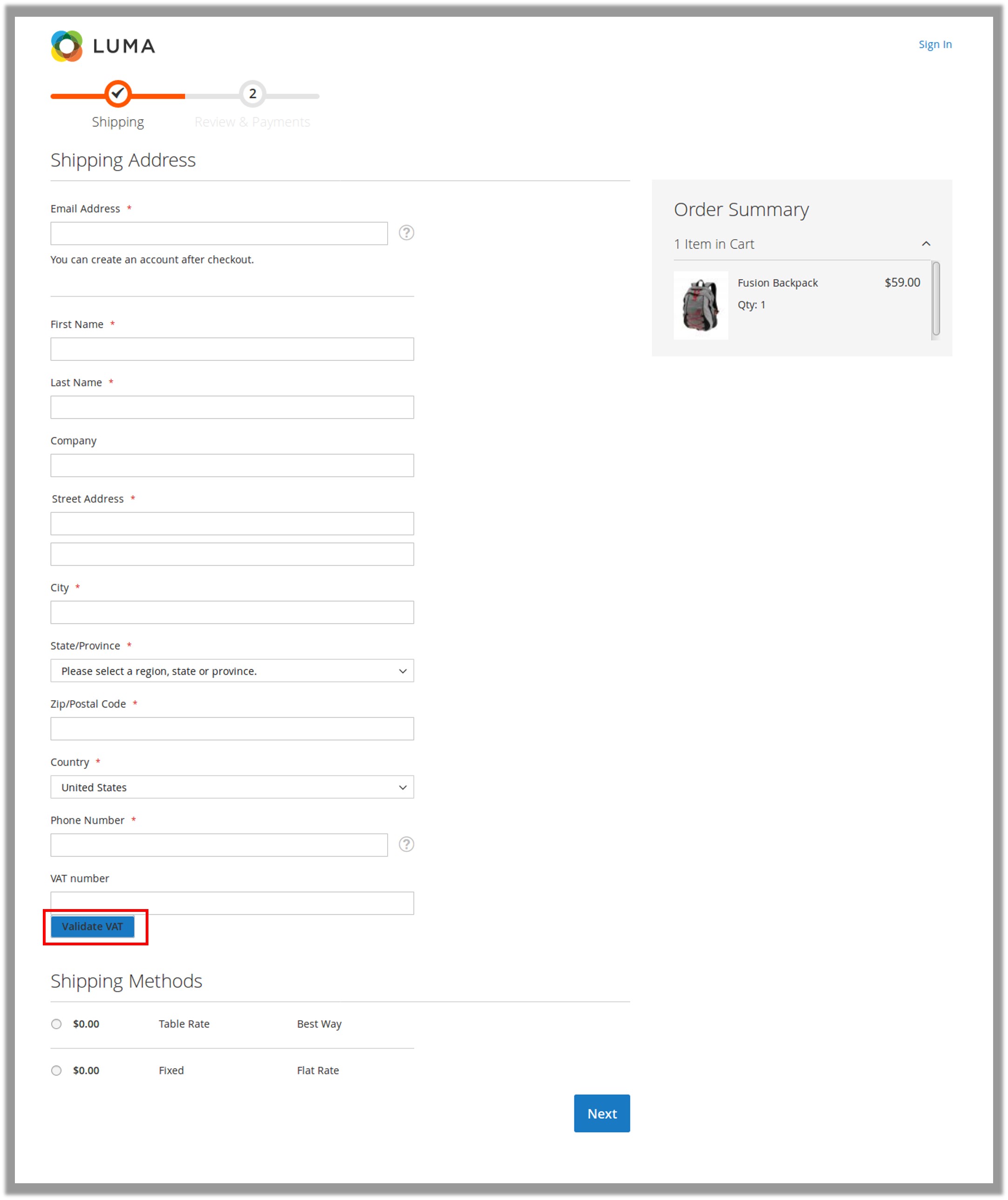

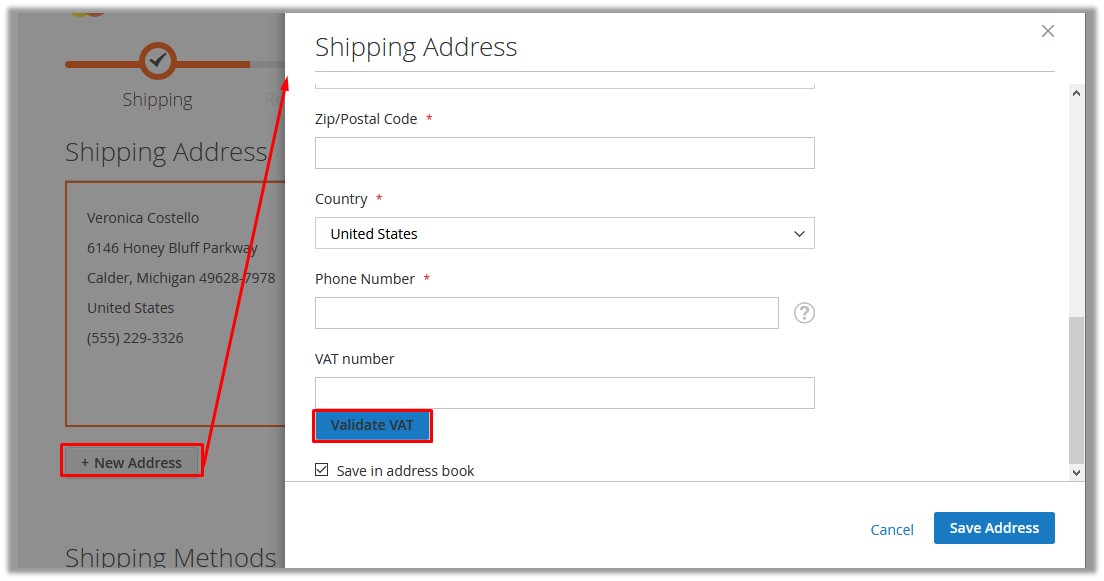

Fourth Occurence:

Shipping Address page During Checkout: The Validate Vat button appears on the Shipping Address page during checkout process and also while adding new address during the checkout process.

Customer can check whether the Vat number is valid or not. It restricts the customers to add the new address if they enter an invalid vat number.

The button appears on the page as shown in the following figure:

- In the VAT number box, enter the VAT number, followed by country name from the drop down list and then click the Validate vat button to check if the number is valid.

Only if the number is valid, the customer is allowed to proceed further to checkout, else the error appears.

During checkout process while addding new address for shipping.

- Click the New Address button.

The Shipping Address page and the Validate VAT button on the page appear as shown in the following figure.

- In the VAT number box, enter the VAT number, followed by country name from the drop down list and then click the Validate vat button to check if the number is valid.

Only if the number is valid, the customer is allowed to proceed further to checkout, else the error appears.

Leave a Reply

You must be logged in to post a comment.