3.1.Product Page ↑ Back to Top

On this page while creating a new product or while managing the existing product, the admin has to set the HSN code value, if available, and the GST Rate based on the applicable slabs.

Harmonized System of Nomenclature (HSN) is a multipurpose international product nomenclature developed by the World Customs Organization (WCO) with the objective of classifying goods from all over the World in a systematic and logical manner.

To set the GST Rate

- Go to the Magento 2 Admin panel.

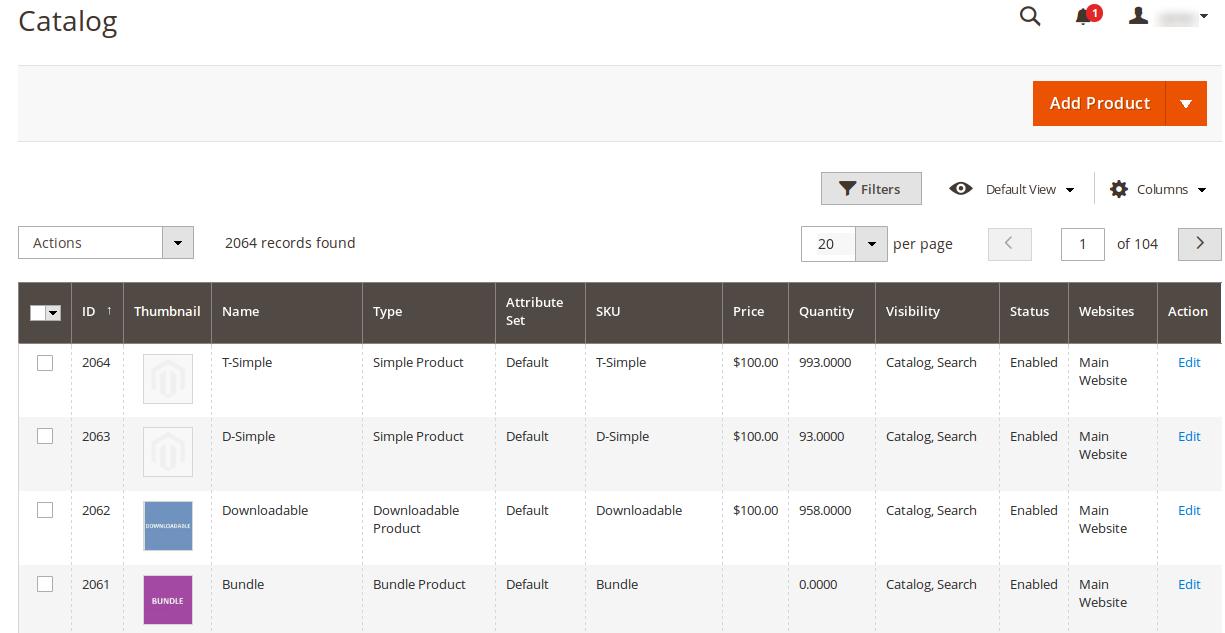

- On the left navigation bar, click the PRODUCTS menu, and then click Catalog.

The Catalog page appears as shown in the following figure:

- Scroll down to required product row.

- In the corresponding Action column, click the Edit link.

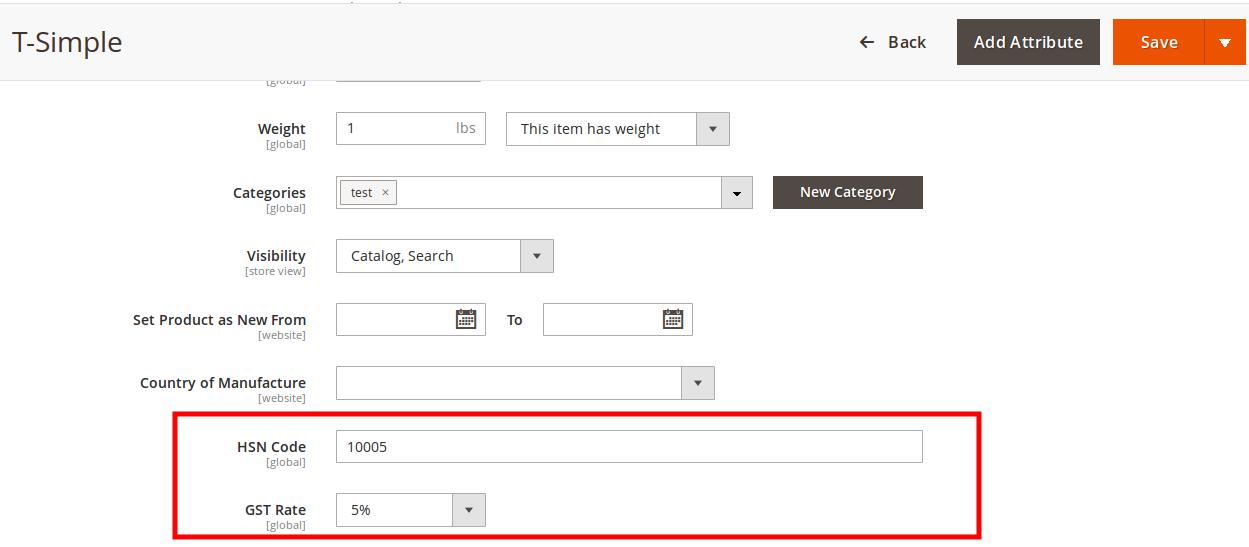

The Product page appears as shown in the following figure:

- Enter the values in the required fields or make the changes if required.

- In the HSN Code box, enter the value.

- In the GST Rate list, select the required option based on the applicable slab.

- Click the Save button.

×