3.2.Order View ↑ Back to Top

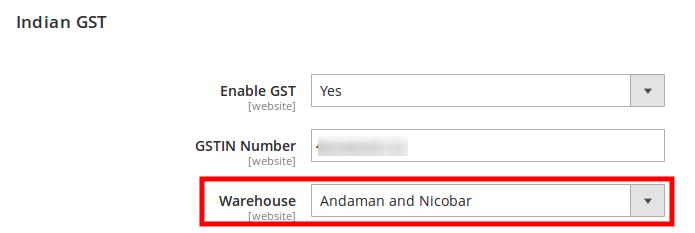

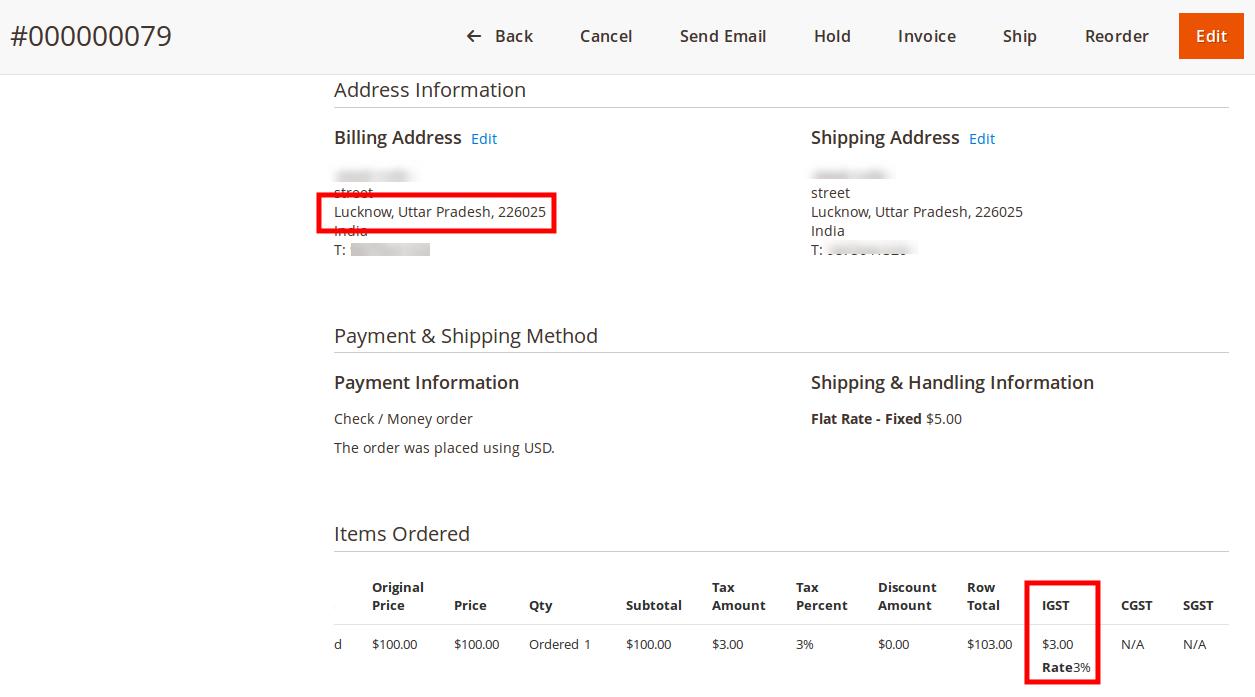

First Scenario: In case of Inter-state sales, only IGST (Integrated GST) is applied. For instance, if the admin has set the value of the Warehouse as Andaman and Nicobar, and the order is placed from a different state such as Uttar Pradesh, then only IGST is applied as shown in the following figure:

Warehouse = Andaman and Nicobar

Order Placed = Uttar Pradesh

Only IGST is applied as highlighted.

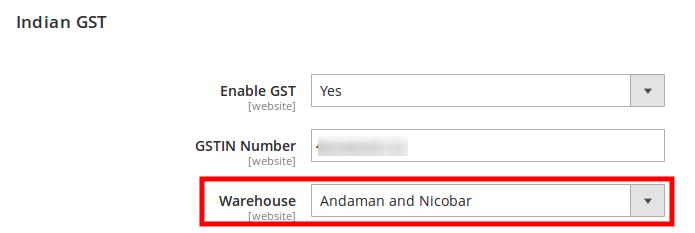

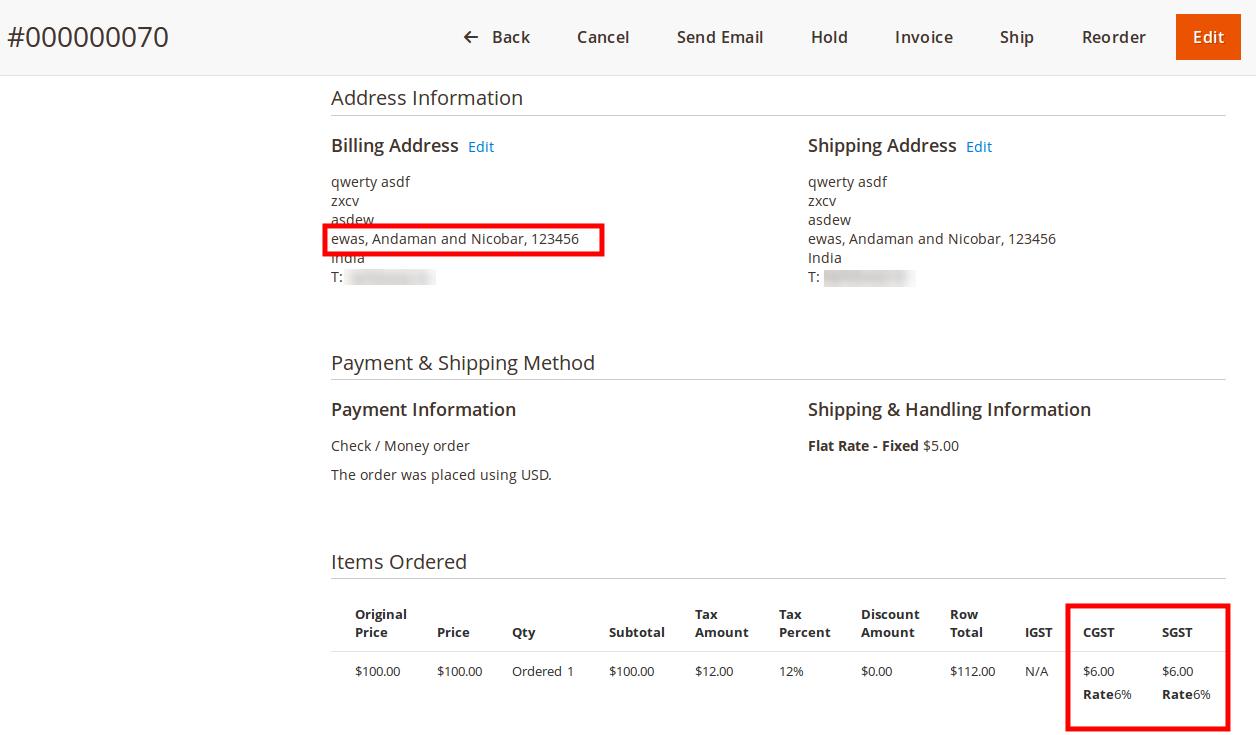

Second Scenario: In case of Intra-state sales, Central GST (CGST) and as State GST (SGST) both are applied. For instance, if the admin has set the value of the Warehouse as Andaman and Nicobar, and the order is placed from the same state, here it is Andaman and Nicobar, then Central GST (CGST) and State GST (SGST) both are applied as shown in the following figure:

Warehouse = Andaman and Nicobar

Order Placed = Andaman and Nicobar

Central GST (CGST) and State GST (SGST) both are applied as highlighted.