4.Vendor Configuration Settings ↑ Back to Top

The configuration settings can be opened by logging-in to the Vendor panel. In the left panel, you will see the Vendor Tax Menu. On clicking Vendor Tax Menu the sub menus will get opened.

- Vendor Tax Classes

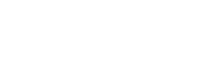

From here the vendor can create Tax Classes according to their use. After the vendor will create the Tax Class it will go for Admin approval. If the admin will approve the tax class only then it will be shown while creating Vendor Tax Rules. The tax class name should be unique as offered by Magento 2.

If the Admin will disapprove the Tax Class then the status of Tax Class will be changed to “Disapprove”. Tax classes created by the vendor are only visible for respective vendor products and admin products.

Tax Classes can’t be deleted if they are used in any Tax Rule according to default Magento 2.- Tax Class Grid

All the tax classes created by the vendor and their current status are listed here.

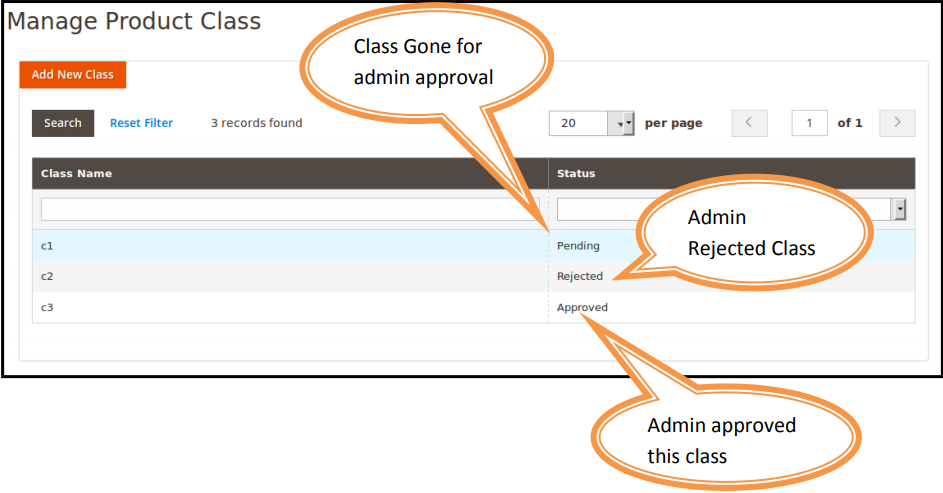

- Create a Tax Class

From here you can create Tax Classes and their names should be unique.

- Tax Class Grid

- Vendor Tax Rates

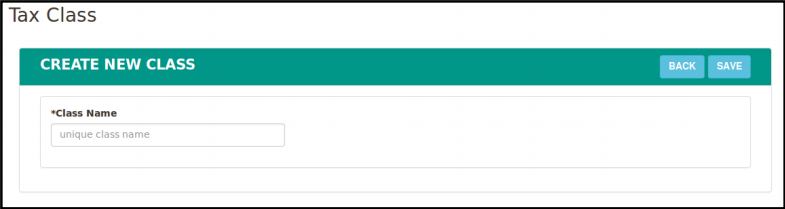

From here the vendor can create a Tax Rate according to country, region, and Pincode. After the vendor had created the Tax Rate it will go for Admin Approval. If admin will approve the Tax Rate only then it will be available while creating Tax Rules. Tax Identifier should be unique as offered by Magento 2.

If the admin will disapprove the Tax Rate then the status of the Tax Rate will be changed to “Disapprove”. Tax Rates created by the vendor are only visible for respective vendor products and admin products.

Tax Rates can’t be deleted if they are used in any Tax Rule according to default Magento 2.- Tax Rate Grid

All the tax rates created by the vendor are listed here with their current status

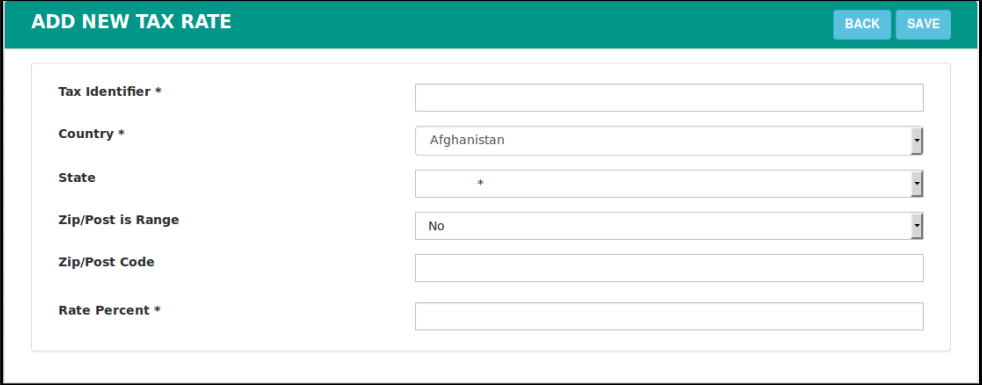

- Create a Tax Rate

From here the vendor can create Tax rates. Tax Identifier should be unique. You can’t create the same rate for the same region if it has already been created.

- Tax Rate Grid

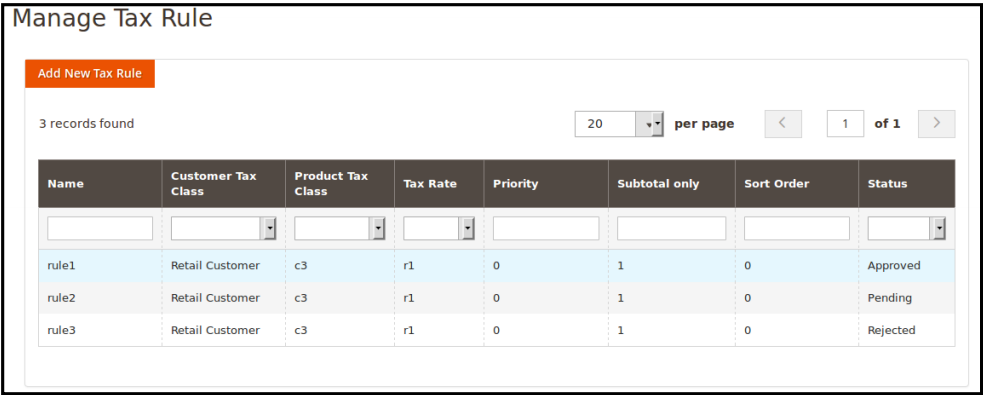

- Vendor Tax Rules

From here the vendor can create Tax Rules by using his own created Tax Classes and Tax Rates as well as he can also use admin created Tax Rates and Tax Classes. After creating the Rule it will go for admin approval. Created Tax Rules will be used for Vendor products only if it is approved by the admin. The name of the Tax Rule should be unique.

If the admin will disapprove the Rule the status of the rule will be changed to “Disapproved”. Tax rules created by the vendor are only applicable to respective vendor products and admin products.- Tax Rule Grid

All the tax rules created by the vendor are listed here with their current status.

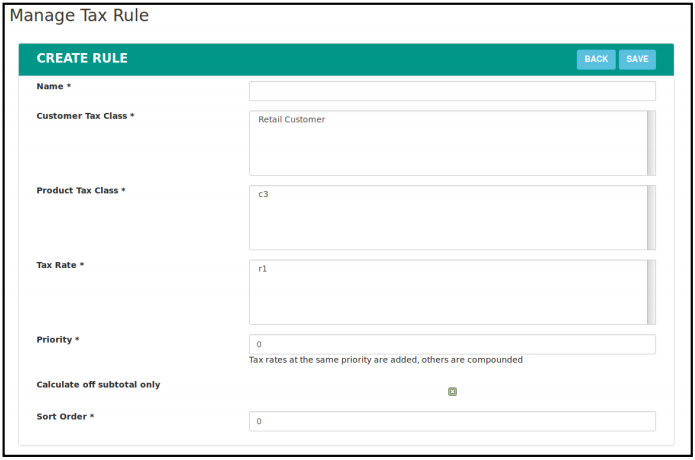

- Create a Tax Rule

From here the vendor can create tax rule by using his created Tax classes and tax rates. He can also use admin created Tax classes and Rates also.

- Tax Rule Grid

×