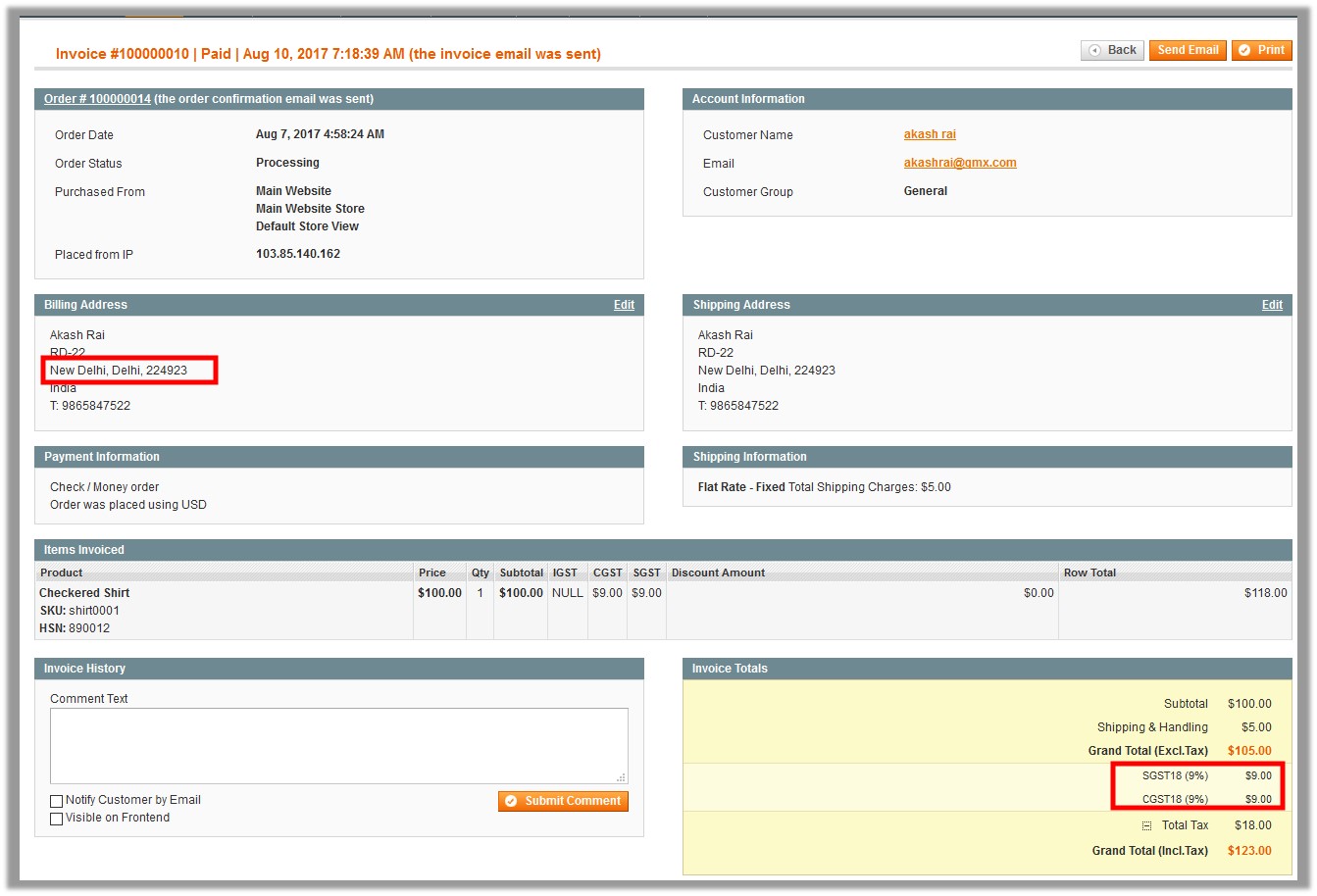

Similarly, based on the inter-state or intra-state sales, the GST is applicable and reflected on the invoices. In case of an Inter-state sale, only Integrated GST (IGST) is applied. In case of an Intra-State sale, Central GST (CGST) and State GST (SGST) both are applied.

Scenario: Intra-State

Warehouse = Delhi

Order Placed from = Delhi

It means, the Central GST (CGST) and State GST (SGST) both are applied as highlighted in the following figure:

Leave a Reply

You must be logged in to post a comment.